- News and Stories

- Blog post

- Tax Benefits

Code for America’s Guide to the IRS Free Tax Filing Survey

In a comprehensive IRS report released in 2023, 72% of people said they’d be interested in using a then-hypothetical free filing tool provided by the IRS. When asked if they’d prefer the free IRS-provided filing tool or free commercial software, a majority chose the IRS-provided option. As a result, the IRS built Direct File. And they did an excellent job: 94% of Direct File users rated their experience as “excellent” or “above average.” Direct File’s Net Promoter Score, a measure of how likely users are to refer others to a service, was +80 (beating out Apple and Google). Despite Direct File’s success, the federal government is moving to cancel the service.

Congress mandated a new survey this summer as part of a push by some to replace the government-run Direct File with private-sector software. The survey itself is hard to read. Nearly half of the survey questions (4 out of 9) require a post-graduate reading level to understand. Other questions and suggested answers lack sufficient context to fully understand people’s true preferences. Because we expect a significant number of survey participants will find some of the questions confusing, we’re sharing some guidance below to help clarify the survey’s questions and assist survey participants. We also share insights from prior research done by the IRS, Code for America, and others that address many of the questions included in this new survey.

Q1: Did you file a 2024 income tax return?

Select your answer based on your situation.

- Yes

- No

- Don’t Know

Q2: How did you prepare your 2024 federal income tax return?

Select your answer based on your situation.

- I prepared it myself on paper

- I prepared it myself using software or an online program I purchased

- I prepared it myself using free software or online program

- I used a paid preparer

- I used a free in-person tax preparer

Q3: How interested are you in using a free online tax preparation program to prepare your next federal income tax return?

Unfortunately, this question is vague. It doesn’t provide any details about the features of the hypothetical program. Still, if you love Direct File and agree with the 72% of people who have previously said they are interested in using a free, IRS-provided service to file their taxes, we recommend indicating you are “Extremely Interested.”

- Extremely interested

- Very interested

- Moderately interested

- Slightly interested

- Not at all interested

Q4: What features do you expect a free online tax preparation program to have?

We know from prior research that people want a free service that is accurate, secure, and easy to use. They appreciate if it is mobile-friendly and want it to be actually free, with no hidden fees or upcharges. We also know that the ability to file both federal and state returns seamlessly is part of what makes a tool easy to use.

The IRS could have written this question more clearly to get a better sense of people’s true preferences. It asks whether people care about filing their federal and state taxes together. However, it ignores the nuances behind that question. Most people are likely to indicate that they want to file their federal and state taxes together. However, what they really mean to say is that they don’t want to prepare their taxes twice, once for their federal and once for their state.

Typically, people prepare and file their federal and state tax returns together when they use private-sector tax software. IRS Direct File mimics this experience by allowing users to file a federal return with the IRS, which then transfers the user and their data to their state’s tax software. Users can then simply add in any state-specific information and finish the state return without having to re-enter all their data. This seamless process became even easier earlier this year, when the IRS started to pre-fill returns with data it already had on file, further reducing the total amount of data entry.

So, how should you answer this question if you, like nearly all Direct File users, are happy with how it solved federal and state filing? We recommend clicking “It can file both my federal and state taxes at the same time” and “Other,” writing in an explanation that “‘At the same time’ could include an integrated government-run federal and state filing that imports my data to make filing easier, like Direct File.” Feel free to include any other clarifications you want in this field, too!

We do not recommend indicating that you expect a free tax filing service to have a low cost to the federal government. This is not because free tax filing services are expensive. They’re not. In 2023, the IRS estimated that Direct File would cost about $64 million to $249 million a year, depending on its scope (that’s about $10 to $15 per return at scale). In reality, the IRS spent less than that over two years combined. Even if the IRS were to spend $249 million a year on Direct File, which is the high end of their original estimate and over seven times their actual annual expenditure over the last two years, that would only be about 1% of the IRS’s annual budget. It would be significantly less than 1% of the $45 billion Americans pay private-sector companies annually to file their taxes.

While free tax filing services like Direct File do have a low cost to the federal government, we don’t recommend you select that as important here, because the survey doesn’t define what they mean by “low cost,” and we worry it could be misinterpreted.

Select all that apply.

- It is easy to use

- My information is kept secure

- My return is prepared correctly

- It is mobile-friendly

- It has a low cost to the federal government

- It can file both my federal and state taxes at the same time

- Other “At the same time” could include an integrated government-run federal and state filing that imports my data to make filing easier, like Direct File.

Q4a: How likely would you be to use an online tax preparation program that was free to file your federal return but there was a fee to file your state return?

The IRS has offered free tax filing in partnership with private-sector tax software companies for the past 22 years. However, the service has allowed users to be charged fees to file their state returns. In recent years, these fees have been as much as $50 per state return. Additionally, since the service had limited eligibility criteria, if a user tried to use the free service and found they were not eligible, they could be charged up to $139 to file their return. Critics have described this as a “free-to-fee” model, and users report being frustrated by a “bait and switch.” As a result, fewer than 3% of eligible people use the free service the IRS has provided in partnership with private-sector tax software companies. Direct File solves these issues by guaranteeing users the ability to file a free federal and state return with no hidden fees or upcharges.

IRS Direct File guarantees users the ability to file both their federal and state returns for free. If you love that about Direct File, we recommend indicating your preference for free software.

- Extremely likely

- Somewhat likely

- Neither likely nor unlikely

- Somewhat unlikely

- Extremely unlikely

Q4b: How likely would you be to use an online tax preparation program that was free to file your federal and state returns, but the state return requires you to use a separate state-run tax preparation program?

This is how Direct File worked, using an innovative approach to allow people to file their federal returns with the IRS and then transfer their data to a state tool to easily file their state return. In a Code for America survey of Direct File users in five states who used the service to file their federal and state taxes, 96% of users found the process “seamless and quick.”

If you, like nearly all IRS Direct File users, are satisfied with the way IRS Direct File enables you to quickly and easily file your federal and state returns directly with the IRS and your state government, we recommend indicating you are “extremely likely” to use such a service.

- Extremely likely

- Somewhat likely

- Neither likely nor unlikely

- Somewhat unlikely

- Extremely unlikely

I do remember it was super nice how I could just transfer all the stuff from the federal taxes that I’ve done. That made it super easy. That was probably the best part, aside from it being free, obviously.

Q5: If you had the option of choosing a free online tax preparation program that has all the features you need, which one of the following would you be most likely to use?

Americans want tax filing services that are free, fast, easy-to-use, prepare accurate returns, and keep their information safe. When people were asked about using an IRS-provided tool versus a private-sector software option, users who preferred the IRS-provided tool indicated that they believed the IRS would keep their data more secure than a third-party company. The IRS-provided option also offered users complete assurance that there would not be hidden fees or upsells.

If you like IRS Direct File and appreciate that it allows you to file directly with the government without the need to give your data to private-sector tax companies or other third parties, then we recommend indicating your preference for a program “paid for and operated by the IRS.”

- A program paid for and operated by the IRS

- A program paid for and operated by a tax preparation company where you go directly to their website

- A program paid for and operated by a tax preparation company, where the tax preparation company is linked directly from IRS.gov

- No preference

Q5a: While a program operated by the IRS is free to you, setting up and running the program is expected to have an initial cost to the federal government of at least $10-$20 per return processed. Knowing this information, which of the following statements applies to you?

Americans pay an average of $290 to prepare and file their taxes each year. That adds up to $45 billion, which is four times the IRS’s total annual budget! Shifting this burden—at less than 1% of the cost—to the government makes sense and is efficient. That’s why people on both sides of the aisle have called for it. While the Biden administration started Direct File, the Bush administration had proposed a similar solution 20 years prior. In another 2023 survey, 76% of people supported the IRS creating a public filing option, including a near supermajority of Republicans and nearly nine out of 10 Democrats. If you appreciate that IRS Direct File ensured the costs of filing taxes with the government may be paid for by the government, we recommend indicating you are “more likely to choose the IRS free online tax preparation program.”

- I am more likely to choose the IRS free online tax preparation program

- I am neither more or less likely to choose the IRS free online tax preparation program

- I am less likely to use this IRS free online tax preparation program

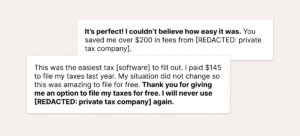

I have used paid online services before and was annoyed with the way they pushed upgrade packages, financial help, and identity fraud protection—all at higher prices. None of that here! Just straightforward tax filing, for free. Amazing!

Q6: If you had the option of using an easy-to-use, free online tax preparation program that has all the features you need, how likely would you be to use that program to file your next federal income tax return?

If you are like the two-thirds of people who have previously said they were very or somewhat likely to use a free, IRS-provided tool like IRS Direct File, we suggest you answer “extremely likely” or “somewhat likely.”

- Extremely likely

- Somewhat likely

- Neither likely nor unlikely

- Somewhat likely

- Extremely unlikely

People want free, high-quality, government-provided tax filing services. They deserve it, and Direct File delivered on it. The next step should be to expand it, not replace it.