Making It Easier for People to File State Taxes

We built a tool that made state tax filing easy and free for Direct File users—proving that it’s possible for the tax system to be simpler and more accessible for all

Impact

- In 2025, taxpayers who used FileYourStateTaxes reported positive experiences with the tool, with 98% saying they were satisfied or very satisfied.

- Nine in 10 taxpayers in our partner states who filed a federal Direct File return went on to complete their state return with FileYourStateTaxes. Among those who imported their Direct File data, 98% completed FileYourStateTaxes.

- Most taxpayers finished FileYourStateTaxes very quickly. In 2025, from the time of data transfer from Direct File, 86% of filers completed and submitted their state return within 15 minutes. The most common experience was to finish this process in under five minutes.

The challenge

In the United States, it’s too hard and too expensive to file a tax return. Tens of millions of Americans pay hundreds of dollars just to fulfill this basic civic obligation, and millions more don’t file at all, leaving their money on the table. For decades, advocates had called for a simple solution: a free, government-owned filing system, that people could trust, and that used government data to make the filing process easy. In May 2023, the Internal Revenue Service (IRS) set out to do just that, announcing it would launch Direct File, the first free, public, electronic tax filing tool in U.S. history. It would be a sea change in the American tax system—but it wouldn’t be easy. Among the challenges: most American taxpayers have to file state returns after their federal returns, but Direct File, as a federal product, would not be able to directly file taxpayers’ state tax returns. The Direct File team had a strategy to create a streamlined and integrated federal-state process—but it would rely on states providing their own filing products to work with Direct File. We set out to prove that this strategy would work.

Our approach

In delivering Direct File, the IRS demonstrated that the government had learned the lessons of the civic technology movement: starting small and iterating leads to better software and an improved client experience. We took the same approach to the state filing challenge. In the summer of 2023, we established partnerships with two states—Arizona and New York—to build an integrated state filing solution for Direct File users. Along with Massachusetts, they would be two of just three states that piloted these solutions during Direct File’s 2024 pilot. We called the new product FileYourStateTaxes.

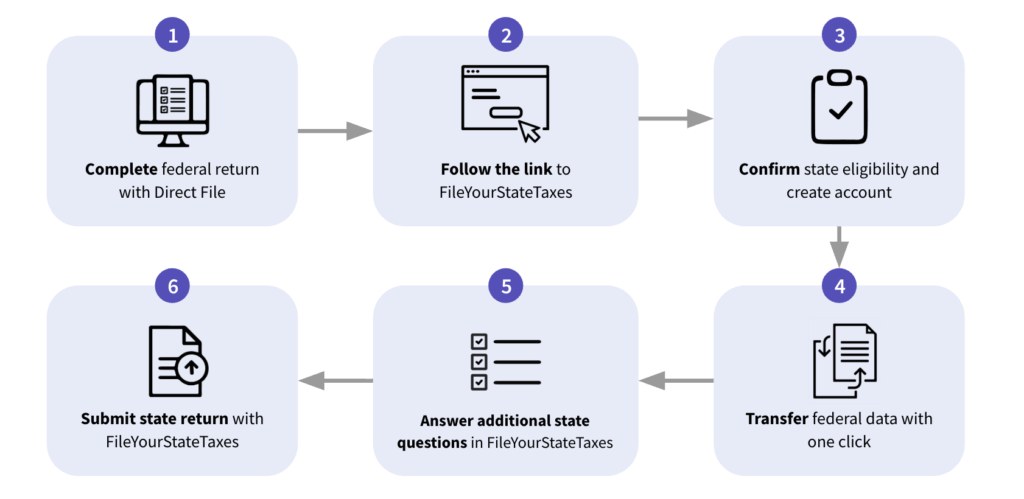

Upon completing their federal return on Direct File, Arizona and New York taxpayers would be directed to FileYourStateTaxes, where, critically, they would import all the data from their Direct File return. FileYourStateTaxes would ask the taxpayers just a few more questions specific to their state situations, and file their state returns. Because most data required for a state tax return is contained in a federal tax return, it generally took no more than a few minutes for taxpayers to use FileYourStateTaxes. In fact, from the time of data transfer, nearly 90% completed and submitted their state return within 15 minutes. You can see an end-to-end demo of the process here.

As with all our products, we approached every portion of the product with an eye toward usability and human-centered design. Our multi-disciplinary team developed designs with taxpayers and tested and iterated on complex functionality. We worked closely with the IRS and our state partners to refine our tax scope and tax language. And we focused on the design practices we know make for a better experience. We used plain language and provided all functionality fully bilingually, in English and Spanish—and we provided empathetic live chat support throughout the product for taxpayers with additional questions.

Outcomes

In Arizona and New York in 2024, FileYourStateTaxes proved that state filing could be seamlessly integrated with Direct File. Nine out of 10 people would recommend Direct File and FileYourStateTaxes to their friends and family, with a Net Promoter Score of 83. Reflecting on the federal-state data transfer, the most unique aspect of Direct File integrated state filing, 95% thought the transfer was “seamless and quick.”

Buoyed by this success, states scrambled in the summer of 2024 to find ways to join Direct File in January 2025. Ultimately, 12 new income tax states joined in 2025, four of which—Idaho, Maryland, New Jersey, and North Carolina—chose to work with FileYourStateTaxes.

By scaling and eliminating barriers to filing a tax return, Direct File was positioned to eventually deliver up to $12 billion a year in tax benefits to low-income families—life-changing refundable credits that go unclaimed every year because it is often too hard and too expensive to file a return. We believed we were on the path to the fully realized 21st century tax system we envisioned.

Unfortunately, in April 2025, media reported that the Trump Administration planned to cancel Direct File. As of late 2025, all this progress is on hold. Still, in 2024 and 2025, FileYourStateTaxes proved that state filing can be integrated into a federal direct file project. Never again can skeptics claim that it’s not possible to make the American tax system equitable and accessible with free, public tax filing; we’ve shown it can be done, and done well.

Read more

Let’s work together to improve government in meaningful ways